Just this past summer, as many as 47 patients in 25 states may have died from VAPI, vaping-associated pulmonary injury, filling newsstands with fear. But did that slow vape sales?

Multiple reports recorded an initial dip after the news hit. Bloomberg reported that in Colorado, “Vape pens accounted for just 11% of total recreational cannabis sales as of Sept. 30, down from 19% in June.”

MJBizDaily wrote in October: “Unquestionably, the torrent of negative press surrounding vaporizers of late has hurt marijuana vape sales—which was the fastest-growing segment of the cannabis industry in 2018.” This drop was most apparent in California, where they note, “Vape’s share of the recreational cannabis market in California fell for four consecutive weeks, from 30.5% the week of August 19 to 24.3% by the week of September 16.”

But ultimately, data suggests that sales have settled down, showing an increase in market share in many legal states, even over flower.

Vape sales are predicted to rise

One example of the dedication of vape customers is the recent increase of vape sales in Maine, despite the governor of nearby Massachusetts instituting a four-month ban on them. MJBizDaily reported that one Maine CEO, Patricia Rosi of Wellness Connection of Maine, said her shops have encountered “nearly triple the number of customers.”

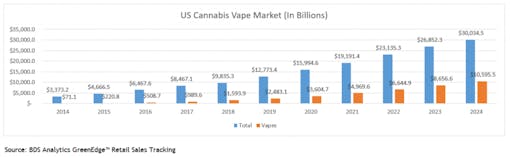

Peeking at some numbers from BDS Analytics, a cannabis data analysis company, the vape sector looks like it’s still coasting and it would take a major iceberg, like legislative restriction or more illnesses, to sink it. The company’s early October report projects an increase of more than a $1 billion for vape sales in 2020 from this year, and a tripling of vape sales by 2023.

Despite the vape scare, vapes sales are projected to rise in the next several years. (Courtesy of BDS Analytics)

Tom Adams, BDS Analytics’ Managing Director of Industry Intelligence, explains why a rise in vape sales is expected despite all of this bad press: “Consumers see vaping as a healthier alternative for inhaling both nicotine and cannabinoids and also salute the convenience and discretion of using them versus burning dried plant material.” People just like vaping, and short of an outright ban, there won’t be any slowdown.

Has the vape scare affected growers?

But could the ongoing negative coverage potentially harm the cultivation or retail sector as things unfold? It fully depends on what, if anything, customers reach for instead of a vape pen. “If usage just shifts to flower, cultivators may gain because they sell pounds of cannabis for flower sales at much higher prices than for processing into concentrates,” says Adams.

Shop highly rated dispensaries near you

Showing you dispensaries nearOne grower who produces both premium cannabis flower and vapes, Sherbinskis’ founder and CEO Mario Guzman, has learned from these past few months. When the news was spreading in August and September, he was definitely concerned for the future.

“During that one-month period where it was really getting heavy and issues were coming up, I think everyone naturally took a step back from vaporizers,” said Guzman. “But it really gave us time to reflect on the fact that we’re a flower company at heart.”

Before vapes were even a thing, Guzman was building trust with California consumers for over 15 years. Doing things the right way has always been a core value for his brand, and Guzman thinks this reputation is something that can’t be manufactured.

“Our sales really weren’t affected as much as we expected, because we only serve to the legal cannabis market and we’re not available on the black market,” he said. “People trust the name Sherbinskis, and they know that when they come into a licensed dispensary to purchase our product that they can trust that it’s safe.”

What about dispensaries?

There is safety in the regulations of legal states, and consumers haven’t been scared off from products with traceable lab testing results and a real company to hold accountable. Sales at some legal shops haven’t seen fallout from recent events.

Adie Meiri, founder and president of Herbarium in Los Angeles, California, counts on their reputation for safe, clean, and potent products to carry them through this rocky foundation period of the cannabis industry. “I believe we do not see the decline in sales as much as other stores might be because we are able to educate our customers,” said Meiri.

This education is key for client retention and trust, and will help them discern between vetted products and potentially hazardous black market options.

Cannabis analysts and industry professionals have been eagerly waiting for the science to sort everything out—and most customers too. States or the Fed may bring down the hammer of regulation, but until they do, many calls for improved testing and study of VAPI are coming from the cannabis industry itself.

With so many billions of dollars on the line—plus the health of millions of cannabis users—it’s on the industry to solve this puzzle, even if it implicates outdated tech in an unimpeachable way. Health is still one of the main reasons people look to cannabis and cannabis products must be safe to be health aids.