What makes a medical cannabis market work? It’s a question that excitable investors and entrepreneurs don’t always consider before entering the industry, and it’s one lawmakers often lose sight of as they work out the nitty gritty details of legalization.

Over the past five years working at Vicente Sederberg LLC, a leading cannabis-focused law firm, I have studied the creation and implementation of dozens of medical marijuana laws across the country. I have modeled and tracked patient enrollment and expenditures, and I’ve developed an understanding of how restrictions within cannabis laws limit market potential. These years of experience have left me with one piece of knowledge more important than anything else: When it comes to market potential, the law matters most.

Under the right conditions, cannabis products will fly off dispensary shelves at speeds driven by the pent-up demand of the existing patient population. But in practice, state laws and regulations often limit access through restrictions on available products, qualifying conditions, and retail locations. More than demographic differences between states, these legal limitations affect a given market’s size and financial viability.

How do you tell a profitable medical cannabis market from a potential dud?

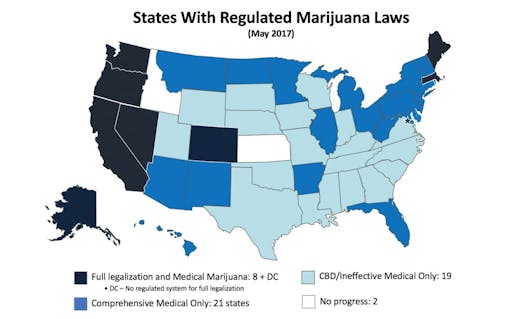

When the cannabis industry comes to mind, people often narrow their focus to just a handful of states with significant news coverage. But currently 29 states and the District of Columbia have comprehensive medical cannabis laws, and another 19 have limited, CBD-only programs that severely restrict the amount of psychoactive THC allowed in medical cannabis products. There are now only two US states without some form of medical cannabis law.

With dozens of states passing laws independently, each medical cannabis system has its own unique features or restrictions. In general, they can be divided into groups based on five simple questions:

- Does the law allow for commercial sales?

- Does the law permit cannabis products with full-strength THC?

- Does the law include chronic pain as an independent qualifying condition?

- Does the law allow for the sale of cannabis flower?

- How many stores or distribution points will be available to patients?

Arizona, California, Colorado, Nevada, Oregon, and Washington all have successful medical cannabis programs with inclusive laws that allow for commercial sales, permit full-strength THC products, include chronic pain as a qualifying condition, allow the sale of smokable flower, and have dozens of dispensary points throughout the state. News coverage often portrays these models as the norm. The majority of states, however, have much more restrictive systems, and these key differences between states can result in business owners making or losing millions per year. In Minnesota, which has just two licensed cannabis businesses, each company has lost millions of dollars in recent years.

All this raises the question: How do you tell a profitable medical cannabis market from a potential dud?

Size of the Market

The first step is to assess the number of registered qualified patients—the medical market’s consumer base, so to speak—in terms that can be compared between states. Analysts often use the term patient-to-population ratio, or PPR. An unsuccessful market typically has a PPR of less than 0.5%, while successful markets typically boast PPRs of more than 1%.

Shop highly rated dispensaries near you

Showing you dispensaries nearMedical Marijuana Systems by State

| State | Commercial Sales? | Full-Strength THC? | Chronic Pain? | Cannabis Flower? | Dispensaries per 10,000 Patients | Patient-to-Population Ratio (PPR) |

|---|---|---|---|---|---|---|

| Colorado | yes | yes | yes | yes | 99.1 | 1.71% |

| Arizona | yes | yes | yes | yes | 8.7 | 1.67% |

| Oregon | yes | yes | yes | yes | 77.6 | 1.65% |

| Rhode Island | yes | yes | yes | yes | 1.8 | 1.57% |

| New Mexico | yes | yes | yes | yes | 7.9 | 1.42% |

| Michigan | yes | yes | yes | yes | N/A | 1.24% |

| Hawaii | yes | yes | yes | yes | 0.0 | 0.98% |

| Nevada | yes | yes | yes | yes | 21.7 | 0.89% |

| Montana | yes | yes | yes | yes | N/A | 0.78% |

| District of Columbia | yes | yes | yes | yes | 10.4 | 0.71% |

| Vermont | yes | yes | yes | yes | 10.5 | 0.58% |

| Massachusetts | yes | yes | yes | yes | 2.7 | 0.49% |

| Connecticut | yes | yes | NO | yes | 6.0 | 0.41% |

| Delaware | yes | yes | yes | yes | 6.3 | 0.17% |

| New Hampshire | yes | yes | NO | yes | 19.1 | 0.16% |

| Alaska | NO | yes | yes | yes | 0.0 | 0.14% |

| New Jersey | yes | yes | yes | yes | 4.3 | 0.13% |

| Illinois | yes | yes | NO | yes | 33.2 | 0.11% |

| Minnesota | yes | yes | yes | NO | 19.9 | 0.07% |

| New York | yes | yes | NO | NO | 15.7 | 0.06% |

| Florida | yes | NO | NO | NO | 36.5 | 0.02% |

| Georgia | NO | NO | NO | NO | 0.0 | 0.01% |

| Utah | NO | NO | NO | NO | 0.0 | 0.01% |

| Missouri | yes | NO | NO | NO | N/A | 0.00% |

Qualifying Conditions

Before estimating a patient-to-population ratio, investors and entrepreneurs must think about what types of patients are even permitted to enroll in a state system. States have OK’d medical cannabis for a range of conditions, from Crohn’s to cancer, but by far the most important qualifying condition to consider is chronic pain.

Chronic pain affects tens of millions of Americans—roughly 11% to 17% of the population—and cannabis has shown to be an effective treatment for symptom relief. By comparison, epilepsy, another condition treated effectively with cannabis medicines, affects just 84 people out of 10,000, or 0.84% of the population. It’s telling that, based on state patient enrollment data from the end of 2016, every state with a patient-to-population ratio above 0.5% includes chronic or severe pain as an independent qualifying condition.

Growing a medical market depends not only on the type of qualifying conditions and available products, but also on how new illnesses and products are added. Most medical cannabis states allow new qualifying conditions to be added at any time by an independent medical review committee. The addition of other products types, however, often requires legislative action.

Consider New York. After passing a highly regulated and restrictive medical marijuana law in 2014, the state Department of Health added chronic pain as an independent qualifying condition in March 2017. The change, along with streamlined processes for medical officials to recommend cannabis, almost doubled the rate of patient registration, from about 29 new patients per day to more than 57 new patients per day. In Minnesota, the addition of intractable pain to the state’s medical cannabis program caused patient enrollment rates to triple. These significant expansions occurred without legislators in either state having to change the text of the law.

Official Enrollment

Even when patients can enroll in medical cannabis programs, there’s a question of whether or not they will. Medical cannabis is often readily accessible on the black market, and the decision for a qualifying patient of whether to register often boils down to whether the benefits outweigh the inconvenience. Is it worth navigating the cumbersome, sometimes expensive process of finding a physician, filling out paperwork, and paying a registration fee in exchange for the legal protection and access to dispensaries that state registration affords? That decision for patients will depend on a number of factors. For example, are there accessible stores to that offer high-quality cannabis products at prices that compete with the illegal market?

If stores are not accessible, prices are high, or common products are prohibited, many qualifying patients will choose to avoid the hassle and expense of registration.

The Significance of Smokeables

Most cannabis patients are accustomed to smoking or vaporizing raw cannabis, but not every state medical marijuana program allows for the sale of flower. As can be seen in the table above, states that prohibit the sale of cannabis flower have the lowest patient-to-population ratios.

Despite recently adding new qualifying conditions, New York and Minnesota permit only cannabis oils, topicals, concentrate pens, and other non-smokable products. In Pennsylvania, smoking or dispensing cannabis in “dry leaf” form is also currently prohibited—but provisions exist in the law to ease that restriction upon a recommendation from the Medical Marijuana Advisory Board. Without the ability to purchase medical cannabis flower, it is questionable that enough patients will register to make the program successful.

The Importance of Access Points

Finally, investors and entrepreneurs must consider the number and distribution of dispensaries in a state. Although it might seem advantageous to be one of just a handful of dispensaries, limited access can backfire as a business model. If obtaining medical cannabis requires two hours of driving and waiting in line, for example, patients could be discouraged and end up making infrequent purchases, buying from illegal sources, or simply avoiding cannabis as treatment altogether.

While it’s clear numbers matter, the precise number of dispensaries needed for a market to succeed is less clear. States such as Colorado and Oregon have hundreds of dispensaries and are two of the most successful markets in the country. But it’s a complicated relationship: Nevada has only about 55 dispensaries and Illinois has 53—but the Silver State is considered a vibrant market while the Land of Lincoln struggles.

The difference between those two markets likely results from the inclusion of chronic pain as a qualifying condition in Nevada, as well as the concentrated population centers of Las Vegas and Reno having easy access to dispensaries.

Too few dispensaries and a market simply stagnates. In Massachusetts, despite an inclusive set of qualifying conditions and an embrace of other factors needed to be successful (such as smokeable flower), the medical market has had trouble attracting patients because there are currently only a dozen dispensaries. That’s about one dispensary per 560,000 state residents. And until recently, none offered delivery services to more remote regions of the state.

Cannabis markets are complex. Each one is unique. For a business to be successful and for a state market to be sustainable, stakeholders must consider multiple factors. The types of products and qualifying conditions included in the program are questions of greater relevance and importance than the size of the state’s population. And if the law is suboptimal, how hard and long will it take to improve the program? Are legislative changes needed to make it successful, or just regulatory adjustments? Most importantly, does the medical cannabis program offer enough benefits to attract the types of patients that drive a successful market?

With the right set of conditions, a medical marijuana market will drive hundreds of millions in cannabis sales each year and allow access to patients who need it. But in the wrong regulatory scheme, a cannabis license could end up being little more than an expensive trophy.

Photo credits: LPETTET/iStock, FatCamera/iStock